Algorand (ALGO) coin at the time of writing is being traded at the price of $1.64. The price had a decrease of 4.11% in the past 24 hours. Today the coin achieved the maximum price of $1.74 and the minimum of $1.60. The coin after an explosive move a few days ago is due to retrace at this point and is currently in that phase. Algo has achieved its all-time high at the price of $3.440 in June 2019 and hasn’t been able to break the price since then. The candle at that time closed in red and went to the bottom of about $0.0958 in March 2020. The price had then showed reversal and moved back up but nowhere it had tried to touch its highest price.

How can Algorand (ALGO) Coin react?

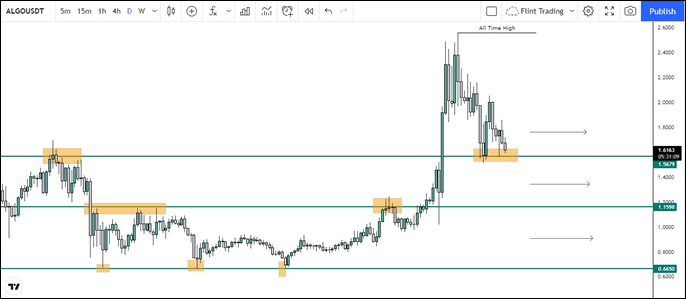

The market on a daily time frame doesn’t have much rather than some ranges. The market before its all-time high and that bullish momentum was just consolidating with low volume within the ranges.

The market was in between the $1.1598 and $0.6650 range for a lot of time. On 8th September 2021, the market was extremely bullish and it rallied up breaking the above 2 ranges. Recently as being the pullback of that massive move the market is testing the level of $1.5679 which is top of range 1 and getting rejected from that on daily.

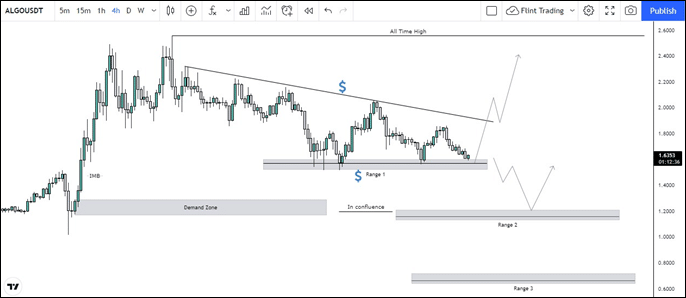

Moving to the 4H time frame, there are two possibilities at the moment. Either price will continue to respect this zone and will break the trendline towards the upside where liquidity is being engineered.

In case if this zone doesn’t hold any further, and it gets broken, the market will be in the second range and can take opportunities from its top and low. But at the moment, the behavior of price is very important to the zones.

Now as being the range 2, That zone is also in confluence with the demand zone that originated that previous move. So it is highly likely that buyers are waiting at that zone and might be ready to jump in again.

Now talking about the probability of which possibility is high.

The confluences are higher that it might break the range 1 and come inside range 2, as the institutions to breakeven their orders have to scroll price down to that demand zone. Moreover, there is an imbalance zone present as well which can cause the price to mitigate that and eventually tap in that demand zone.