OMG being one of the coins that is still stable when the bitcoin was falling is struggling to rally up. This coin although has been correctively pushing up without crashing.

At the time of writing OMG is traded at the rate of $11.68 and has extremely potential in the future. The max supply and circulating supply have been equal now which is around $140,245,398.25 The coin has an increase of 11.74% within the last 24 hours.

Talking about this month, OMG actually increased with an enormous percentage which is around 83.81%. similarly, as coin being correctively bullish the previous month i.e. August, it gained another 41.93% which is quite impressive. this coin is ranked on number 62 at the moment according to the coin market cap data.

Technical Analysis – OMG

Seeing the record of this coin, the market as being very bullish for the last two months has increased by a total of more than 120%. Now seeing the past movement, the coin as mentioned before is correctively bullish. After every bullish gains, market retraces and keeps the price healthy towards upside. The price on daily time frame, the stance increase to much more extent as there are much evidences of bearish movement.

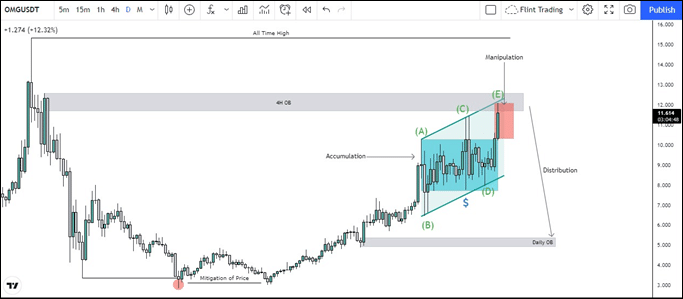

On 11th May the market left an order block within the price which at the moment market is testing. It is possible that market might show some sort of reaction towards it.

Just after that order block formation, price has been extremely bearish and breaking structures to the downside. On 21st June much orders were again placed but it didn’t unfold and it changed the trend, this can be considered as Wyckoff spring move and afterwards the market has been extremely bullish and being efficient overall.

The recent price action onwards from 6th September 2021 is quite great. Some decent confluences to be added in while taking a position.

As mentioned before the price is testing the 4h order block which itself can show some sort of reaction. Secondly, a triangular Elliot wave seems to have been observed which clearly shows the termination of this bullish move. The price is around the 3 points, and according to the theory, an opposite move can be expected. Moreover this according to smart money concepts is likely to be an AMD pattern. From 6th September 2021 to 29 September 2021 the market seems to be in an accumulation phase, and now a manipulation phase is taking place and a distribution phase can be expected. Now all these three confluences gives an evidence of selling but one thing which opposes is volume. The bullish volume is extremely high. Unless and until market doesn’t show a market shift and loss in momentum it is not recommended to take a short position. As everything specific should be taken in consideration.

if plan follows and zone does hold, possible target can be the daily orderblock present at $5.364. Now if the 4h orderblock doesn’t hold , a retest to the all time high can be expected.