DCR according to the higher time frame is very bearish at the moment as much decrease in the coin value has been observed. on weekly time frame, a correction wave of the impulsive move is being observed which made all time high of this coin recently.

Moving to daily time frame, the price clearly isn’t showing any clear direction at the moment, rather a move within the range is being expected.

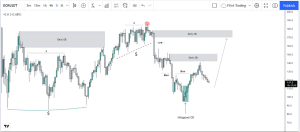

The price when in initial stages of this consolidation, started building liquidity to both top and down side. The top one as being under the orderblock was soon taken out by the price from where it showed quite a good reaction on 1st of August 2021.

Now soon after that, price returned to that similar orderblock, but this time as being all the orders mitigated, the price passed just from that doing a stop hunt of the consolidation before and fell momentously to the downside, leaving behind imbalance in 7th September candle and 20th September candle. Now the second candle i.e. 20th September candle was soon filled by the next correction of the price which leaves the upper one unmitigated which can drive the price to mitigate those.

Now talking about the recent price action, the price has shown structure shifts to the upside, which shows market might continue higher for some time as this structure shift originated from an order block which was laying unmitigated from 20th of July 2021. Now as mentioned there’s imbalance to the top side, structure shift to the upside gives more confluence to the upside, furthermore, there’s no reason for market to push down except liquidity which can be a target for price on a later date as the orderblock is mitigated below and there’s no imbalance below.

Now if the price bypasses the below mitigated orderblock, it would be invalidation for longs, and unless price doesn’t grabs liquidity below, only shorts will be preferred.

Price Movement

At the time of writing DCR is being traded at the price of $115.7. The price had a decrease of only 1.17% in the past 24 hours but is currently forming a new structure that probably wouldn’t break the last one resulting in the reversal of the trend. The last month was super bearish and dropped the price by 39% bringing it back to the price it had achieved during the crash of the market.